Towards a new risk model

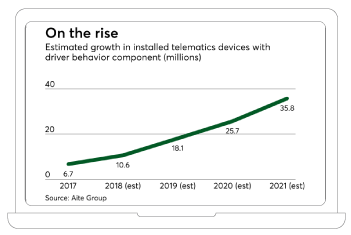

Establish more precise and personalized insurance premium calculation for your clients based on their driving behavior. Telamatics data is dynamic data that allows to establish a more robust profile to measure risk risk.

Our PHYD (Pay How You Drive) solution processes and uses telematics data to manage a driving score system which includes relevant variables such as hard acceleration, hard breaking, hard turns and speeding.

Greater engagement = Better driving

Drivers with high engagement through the app, which means that they interact more and are informed about their driving habits, improve their driving score by 40% in one year.

Focused in attracting new clients

Automotive insurance policies in Latin America do not exceed penetration rate of 30%*, expect for mandatory policies such as SOAT and its equivalents. Thanks to UBI programs, we can now develop new digital products to capture new users with a new value proposition. The PAYD (Pay As You Drive), or payment by kilometer driven, allows to attract new potential clients that are uninsured and that drive less than 15,000 kms annually. The information provided by this new insurance model is less confusing to clients; it reinforces transparency, trust and loyalty.

We Accelarate Vehicular Insurtech

As a business partner, not only we develop and integrate technology, but we create digital products where we integrate automotive insurance policies in our services in order to be relevant to new consumers and digital players.

We aim to capture and adapt to new market segments in this ever-changing ecosystem by descovering new uses for insurance such as Car Sharing, Car Renting, Fleet Management, Last Mile Delivery, On Demand Trucking among others.

Operating Capacity

We operate in sevaral countries in LATAM, and this allows us to be close to your market and to be there for you.

We are the only Company with capabilities to provide a complete operating support that includes the telematics device import process, connection, installation, inspection, and post-sale service. Such a complete fulfillment service allows the insurance company to focus on its main business.

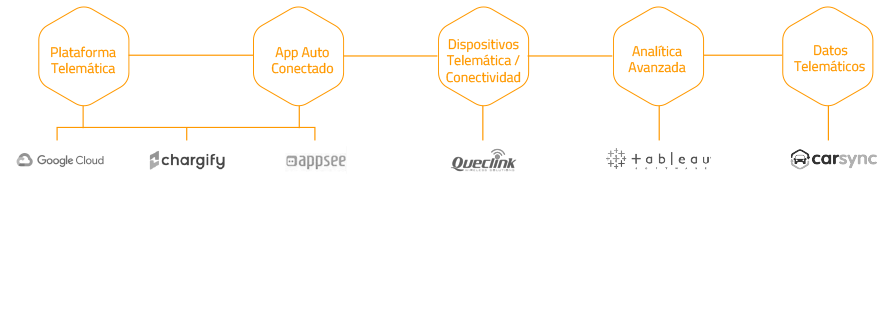

Partners

Solución Tecnológica Modular

Mobile Apps in 90 days

If you would prefer a packaged solution, we have options to

customize your app in record time.

API and Integration

If you prefer a customized service, we provide an independent

and complete solution to develop a UBI solution.

DATA GENERATION

(IOT DEVICE) We capture “raw data” from the telematics devices and senors in the vehicles

DATA CLEANSING

After capturing the data, telematics data is processed through the use of algorithms, machine learning components and statistics in order to determine which data is valuable data from each trip.

RATING

For PAYD models, we offer the possibility to establish and configure different service packages, quote per kilometer and other business rules that will allow the insurance company to bill and collect.

BEHAVIORAL ANALYTICS

We deliver aggregated and disaggregated data that can be integrated by third party applications or systems through APIs and other information delivery methods.

Data Analytics

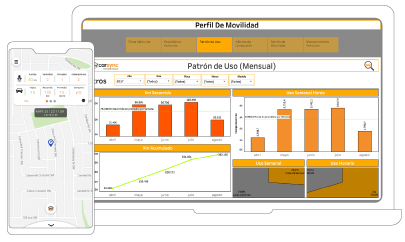

We develop different use cases that allow us to have a better client profiling in order to understand mobility patterns and use of vehicles.